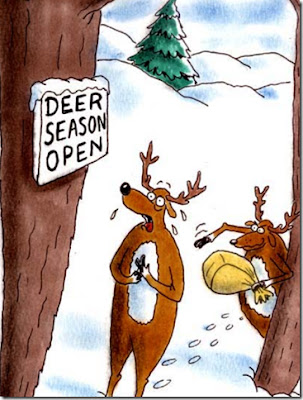

Click on the date to see this complete item along with the proper spacing and to view the comments that I know will come. Developer bashing is a sport the rest of us can do when the boys go hunting.

|

| Developers taking aim at the Downtown Core? |

IT IS RECOMMENDED THAT: Planning Report No. PL-2012-107, prepared by Chris Marshall, regarding the implementation strategy for the Community Improvement Plan be received;

AND FURTHER THAT: the Corporate Services Committee recommend Staff prepare a Bylaw to outline the following incentives that can be used to implement the Downtown Core Community Improvement Plan:

1. Tax Increment-Equivalent Grant Prgram;

2. Development Charges Grant Program;

3. Application and Permit Fee Grant Program; and

4. Cash in Lieu of Park Grant Program.

AND FURTHER THAT: the Corporate Services Committee recommend Council amend the Development Charge Bylaw to remove the development charge exemption for the Community Improvement Plan Area in order to be able to use the exemption as a future incentive;

AND FURTHER THAT: the Corporate Services Committee recommend Council amend the Zoning Bylaw to:

- Increase the permitted residential density in the Community Improvement Plan Area (CIPA)

- Decrease the parking requirements in the CIPA; and

- Incorporate height and density bonusing in the CIPA

AND FURTHER THAT: The Corporate Services Committee recommend Council request District of Muskoka Staff be authorized to amend the District Development Charges Bylaw to enable deferral of District Development Charges in Community Improvement Plan Areas.

BACKGROUND

The Town of Huntsville Adopted the Community Improvement Plan (CIP) for the Downtown Core on March 21, 2011. The CIP is a long term vision for Downtown Huntsville and outlines a strategy to implement the vision. The vision in the CIP includes, design guidelines, green building guidelines and a number of proposed changes to the streetscapes and parks in the area. In order to implement this vision the CIP identifies a number of grant and loan programs that promote redevelopment in the area.

On September 19, 2011, the Official Plan was amended to require all new development in the Downtown Core to follow the design guidelines in the CIP. On September 26, 2012 the Planning Committee reviewed a report from the Director of Planning summarizing the proposed implementation of the CIP financial incentive programs. At this meeting there was concern from some of the Committee members around the recommendation to consider a reduction in the parking requirements in the CIP area and to consider Height and density bonusing in this area. As a result of this concern, the motion to proceed with the implementation of the CIP was defeated and it was suggested that the issue be brought to the Corporate Services Committee that includes all of Council.

PURPOSE

The purpose of this report is to provide the Corporate Services Committee with a suggested approach to encouraging desired development and redevelopment of buildings and landscapes in the downtown core.

The Community Improvement Plan outlines a number of incentive programs that the Town could implement to encourage appropriate development but there are also a number of Zoning Bylaw amendments that could be incorporated to encourage development in this area as well.

DISCUSSION

Section 106(1), and 106(2) of the Municipal Act, 2001 and Section 28 of the Planning Act allows

municipalities to prepare community improvement plans (CIP). The intent of the CIP is to encourage the redevelopment of particular areas of the Town and provide financial incentives to property owners in the area who want to develop or redevelop their properties. The area that the CIP will cover is designated by Bylaw. Once the area has been designated a community improvement plan can be prepared. The Huntsville Downtown Community Improvement Plan was prepared by the Planning Partnership in conjunction with the Town and its citizens and was adopted in March 2011.

The plan outlines a number of goals and objectives to be achieved in the Downtown and sets out a number of incentives the Town could offer property owners. The incentive programs listed in the Community Improvement Plan are intended to encourage property owners to develop or redevelop property in a style and density that is in keeping with the downtown core.

The programs offer grants on Town fees and charges, reduced taxes and a variety of loans and grants. The incentives offered by the Town can only be obtained if the property owner incorporates specific things within their development such as underground parking, affordable housing and green building practices.

In order for the Town to be able to give private property owners grants for taxes, fees and charges, it must either within the CIP Bylaw or through a supporting Bylaw outline exactly what the property owner has to do in order to get the grants. The intent of the Bylaw is to provide the general public with a detailed process by which grants for taxes and fees will be waived as the public will want to know “what do we get in return for giving up these taxes and fees”

The key to writing the bylaw to implement the incentive programs suggested in the CIP is to establish what goals and principles the Town wants to achieve in new development and what kind of weighting to provide each of these things. For instance, if the Town wanted to encourage underground parking in new development in the Downtown Core it could provide grants for taxes and fees to make it more financially viable for developers to build underground parking. The same could be done to encourage green building practices or affordable housing.

The CIP recommends 8 incentives that the Town could use to encourage redevelopment of the Downtown Core and they are:

1. Redevelopment Tax Rebate Program – mitigates the large tax increase that results when a property is redeveloped.

2. Planning and Development Fees Rebate Program – rebate for application fees incurred for

demolition, bylaw amendments, site plan applications etc.

3. Development Charges Exemption/Reduction – Changes required to the Development Charges Bylaw.

4. Property Acquisition, Investment and Partnership Program – acquisition and rehabilitation of key strategic redevelopment parcels. Money can be used from the tax rebate program to purchase land.

5. Façade Improvement Grant Program or Loan Program – Town provides grant or loan for businesses to improve the appearance of building facades

6. Landscape Improvement Grant Program – Town provides grants to building owners to improve the appearance of existing landscapes within Downtown Huntsville.

7. Residential Loan or Grant Program – Town provides financial assistance to convert upper storeys of buildings or add residential units to existing buildings.

8. Commercial Property Improvement Loan or Grant Program – is intended to improve the appearance of commercial properties in the CIP area. An example of where this program could be used is for improvements to the back of buildings facing Rivermill Park.

Community Improvement Plan Implementation

There are a number of Bylaws and Official Plan Amendments that are required to implement a Community Improvement Plan. Section 28 “Community Improvement Project Area” of the Planning Act outlines what a municipality must do to create and implement a Community Improvement Plan. The Official Plan must state the areas of Town that Community Improvement Plans may be considered and what the purpose of the CIP’s are. In Section 12 “Community Improvement and Property Standards” of the Official Plan, the Town has identified four areas of Huntsville that could be considered for CIPs. Section 12.2 of the Official Plan outlines the purpose of the CIP for the Commercial Core of Huntsville and the types of incentive programs

that could be used to encourage development in the area.

Staff have reviewed the incentive programs being suggested in the CIP and are recommending that the Town adopt four of these incentives at this time including the

1. Tax Increment-Equivalent Grant Prgram;

2. Development Charges Grant Program;

3. Application and Permit Fee Grant Program; and

4. Cash in Lieu of Park Grant Program.

These programs will offer the largest financial incentives to the property owner and do not require Council to budget money specifically for these programs as they are associated with reductions in fees and taxes that a property owner would have to pay as part of a new development.

The other five incentive programs are typically for small amounts of money per building and require Council to put aside pools of money that the property owners can draw from when they make improvements to their buildings or landscaping. In these times of budget cutting, it is assumed that raising taxes to provide money for the incentives programs will not be a high priority.

The CIP identifies two priority areas for redevelopment and they are the Old Empire Hotel site and the redevelopment of the buildings that back onto Rivermill Park. The recommended incentive programs will work for both of these areas. The other five incentive programs would be relevant to the buildings that back onto Rivermill Park but are less relevant to the Empire Hotel Site that does not have an existing building.

In order to determine which developments are eligible for the incentive programs, the Town is required to list the attributes of a development that would meet the goals and objectives of the CIP. Staff have identified a list of things that a developer could incorporate into their development that would make them eligible to get the rebates. The type of things that could be incorporated into a development that would be eligible for the incentive programs are:

1. Underground or parkade Parking

2. Green Building practices (Solar Hot water, green roof, alternative energy (eg Geothermal),

insulation, etc.)

3. Affordable Housing

4. Residential Units less than 600 sq ft

5. Mid Block Connection

6. Integrate an arts and culture component

7. Enhanced building presence on Rivermill Park

8. Streetscape improvements and public amenities

9. Active Transportation (Secure indoor and outdoor bike parking, showers, benches, bus stop)

10. Incorporating public meeting space

11. Enhanced accessibility (visitable units, family washrooms etc)

12. Provide public parking

13. Incorporate street improvements for Main Street and Minerva

14. Land Assembly for Empire Block

15. Incorporate library

16. Landmark Site with visual interest

17. Establishment of a car coop

Each of these items could have a weighting attached to them to determine how much of a rebate the property owner could get. For instance, the underground parking could be encouraged by providing a set amount of money be rebated for each parking space that is constructed underground.

In each of these Grant programs, the Town would collect the full amount of the Taxes, fees or charges and grant this back to the property owner.

Tax Increment-Equivalent Grant Program

Section 28(7) of the Planning Act enables the Town through the adoption of a Bylaw to provide grants or loans to a property owner within the CIP area. The Bylaw specifies what makes you eligible to receive the grants and loans and how long they will last. The Bylaw must state how the municipality will verify the conditions of the grant have been completed. If the conditions are not met then the property owner is notified that they must pay their taxes with added interest.

In the attached Draft CIP Implementation Bylaw staff have outlined for each of the grants, the rationale for the grant, the legislative authority for the grant, the details of the grant, what makes you eligible to apply for a grant and the process of applying and getting approval for a grant. In the case of the Tax Increment Equivalent Grant Program, staff are recommending that 100% of the increase in the taxes as a result of development or redevelopment be granted in the first year and be phased down over a 10 year period.

Hiç yorum yok:

Yorum Gönder